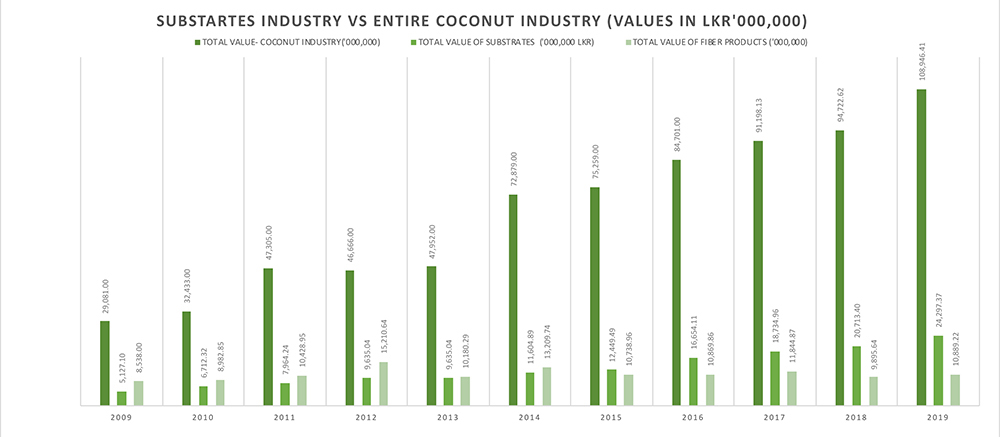

Agricultural exports still contributes to more than 20% of the annual exports of Sri Lanka and coconut enjoys the third place as an agricultural export next to Tea and Rubber. Contribution of the coconut industry to GDP has continually declined since independence due to the diversification of the economy, which mainly depended on three main planation crops (tea, rubber and coconut) in the colonial era. Coconut industry became especially vulnerable due its wider geographical spread of plantations and as successive governments were oblivious to the fact that a range of value–added products could be developed from almost every part of the coconut tree. Coconut cultivation covers about 400,000 hectares (6% of the total land area of the Island) and annually bears around 3 billion nuts of which more than 1.8 billion are domestically consumed as various edible foods and oil. The industry has shown a recent revival and has been having an increased share in the total exports earnings since 2014 (more than 5% of the total exports earnings) due to the increased export volumes of more value-added products such as coconut-based substrates, Virgin Coconut Oils and Coconut Milk and Coconut Water.

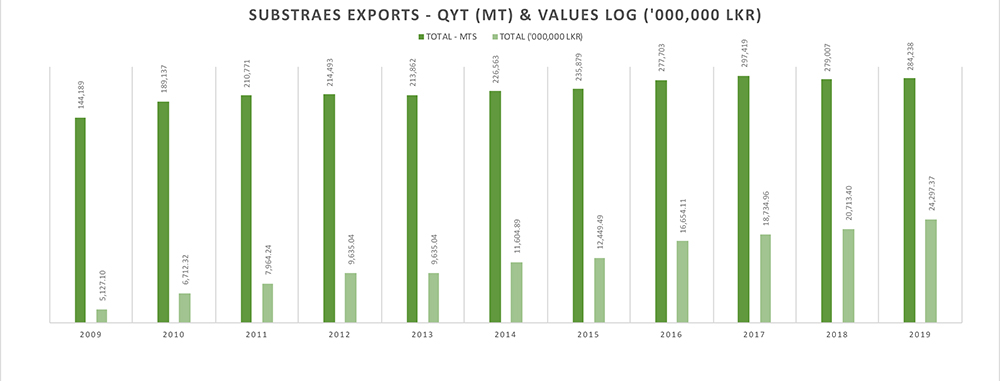

Accidental discovery of suitability of coco peat as a growing medium few decades back has totally changed the landscape of the coconut industry. What has been regarded as a hazardous industrial waste not long ago as 1980s has now become the main earner of the export revenue in the coconut industry. Starting from very basis products, the substrates industry continuously kept its momentum in value-addition as shown in Figure 01

Though increase in export volumes started stagnating since 2016 due to the reasons discussed in latter parts of this document, the momentum of value-addition kept the substrates industry growing annually by more than 15% since 2013(Figure 01. That made it possible for the industry to post 135 million USD in export earnings in 2019, which is 22% of total export earnings of the coconut-based

The country has an ambitious target of achieving 1 billion USD mark of earnings by exporting coconut- based products by 2023 and the expected contribution from the substrates exports alone could be 300 million USD if timely solutions are given for the problems the industry is facing.

Current growth momentum in the substrates industry can be maintained and can even be accelerated by simultaneously increasing the proportion of value- added products in exports and also by increasing volumes exported. However, achieving this will depend finding lasting solutions for the problems industry is facing now.

Increasing value addition: The per kg value of exports of coconut based substrates has been increasing by 10-15% annually irrespective of the fact that increase in export volumes are marginal mainly since 2016. (Figure 01). This is the main contributing factor for the continual increase in export earnings. While trying to increase export volumes further, industrialists should be encouraged to increase exporting more of value-added products such as washed and buffered substrates solutions, which will always bring higher per kg value to the country.

Increasing export volumes: Increasing export volumes is the main challenge, which the industrialists currently face. As Figure 01 shows, between 2015 and 2019, the increase in export volume was just 20%. However, the growth momentum was maintained mainly due to the increase in value addition. The scarcity of raw materials is the biggest issue, which should be resolved if the industry is to increase it exports volumes in a sustainable manner.

Scarcity of Raw Materials: This is the biggest issue now the industry faces mainly due to the stagnation of coconut yield and for substrates industry in particular the barriers of accessing the huge amount of unutilized coconut husks. Due to all these factors combined, there is a sever scarcity of husks and coco peat as a result. As Figures 01 clearly shows volume of substrates exported has doubled from 2009 to 2019 but the percentage increase from 2015 to 2019 is just 20% and from 2018 to 2019, it was mere 1% due mainly to the scarcity of required raw materials. There are immediate actions to be taken, which should be supplemented with long-term solutions if the substrates industry should get enough materials to keep the current growth momentum intact if not increased it further.

Immediate or short-term solutions

An immediate and one of the most feasible solutions is finding ways and means of accessing husks, which are not utilized. It is estimated that, out of around 3 billion husks annually generated, only 1 billion is consumed by the fiber and substrates industries. The fate of balance 2 billion is not well known other than the portion of it used in large plantations to enrich soils. We have to do a proper survey to find out what happens to the husks, which are not coming to the industry and should develop channels to bring the same into the usage. It seems that this can be done at the level of industrialists without given a burden to regulating bodies and the government, which can then focus long-term solutions.

Long-term solutions

There are quite a large number of measures, which can be taken to increase the coconut yield in general with the intervention of regulating authorities and the government. Some of them are increasing productivity of existing plantations (irrigation/ fertilizer), developing new plantations in suitable areas, replanting senile plantations etc.

Exporter Association of Coconut Based Substrates

We are the only association of industrialists engaged in the business of manufacture and export of coconut- based substrates. We are product has more than 100 entities in our membership covering small, medium, and large scale players in terms of production and export volumes.

109/02, 02nd floor, Negombo Road, Pannala, Sri Lanka

info@eacbs.lk

Copyright © 2021 All Rights Reserved. Design By Miracle Creative